child tax credit portal

All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The IRS will pay 3600 per child to parents of young children up to age five.

. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. The IRS is updating the CTC Update Portal over time. You can also use the tool to unenroll from receiving the monthly.

Its since been expanded so that for the current year its worth. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child. WASHINGTON The Internal Revenue Service this week launched a new Spanish-language version of the Child Tax Credit Update Portal CTC.

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of. The advance is 50 of your child tax credit with the rest claimed on next years return. IR-2021-235 November 23 2021.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The agency offers interpreters in more than 350. Half of the money will come as six monthly payments and half as a 2021 tax credit.

If you did not file taxes you only need to take a few simple steps to get the Child Tax Credit. According to the tax agency the Child Tax Credit portal was built out as an online app that allows non-filers to report basic information in order to still receive their child tax. The Department of Social Services recommends.

You can use it now to view your payment. June 28 2021. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit.

Open a GO2bank Account Now. Families who are eligible for CTC Portal can get advance payments of 2021 Taxes before they. Already claiming Child Tax Credit.

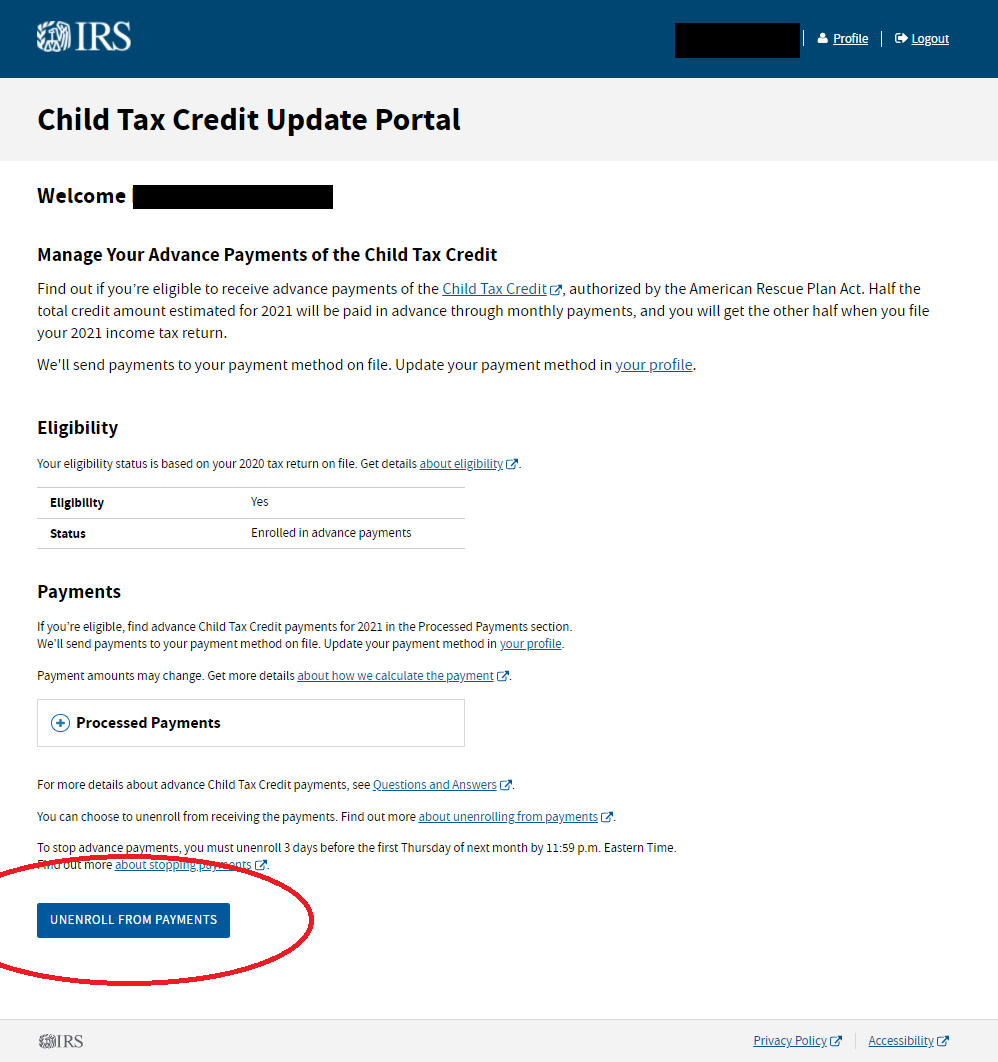

Ad Get Your Bank Account Number Instantly. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. Up to 7 cash back with Gift cards bought in-app.

Before the American Rescue Plan the Child Tax Credit was worth up to 2000 per child under the age of 17. This section will help you identify Child Tax Credit payments you have received and tell the difference from other tax benefits. Making a new claim for Child Tax Credit.

You should use the Child Tax Credit Update Portal CTC UP on the IRS website to let the IRS know about changes to your situation. Set up Direct Deposit. 3600 per child under 6 years old.

Click the blue Manage. 3000 per child 6-17 years old. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child.

No monthly fee weligible direct deposit. Visit the IRS website to access the Child Tax Credit Update Portal Go to httpswwwirsgovcredits-deductionschild-tax-credit-update-portal. IRS started Child Tax Credit CTC Portal to get advance payments of 2021 taxes.

Individual taxpayers can call the IRS helpline at 800-829-1040 from 7 am. You will get the Child Tax Credit automatically. The amount you can get depends on how many children youve got and whether youre.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit. Families with children are now receiving an advance on their 2021 child tax credit. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. Advance Child Tax Credit Opt-Out Portal is here. Our child tax credit calculator tells you how much money you might receive in advance monthly.

Sign in to your account You can also refer to Letter 6419. You can use the IRS Child Tax Credit Update Portal to view. Local time for telephone assistance.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Childctc The Child Tax Credit The White House

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back